26

Feb

Merging or Restructuring: The Best Path for Sustainable Growth in Real Estate, Professional Services and Tech Companies

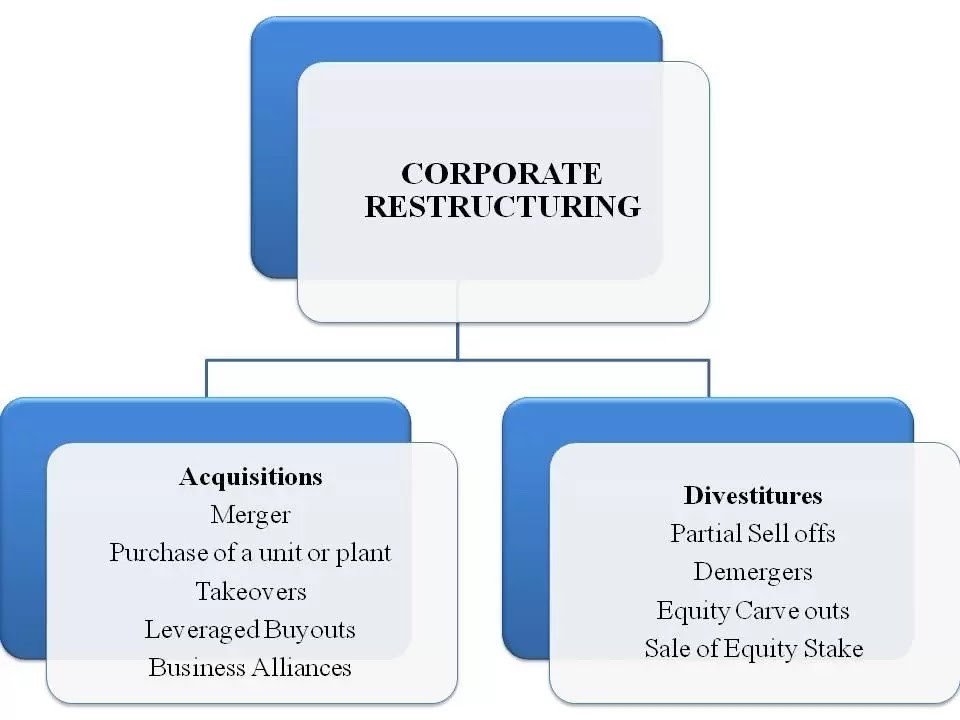

In today’s fast-paced business landscape, companies across various sectors are pursuing sustainable growth strategies to stay ahead. Merging with another company and restructuring are two popular approaches to achieve this goal. But which one is the better option? Let’s dive into a comparative analysis of these strategies in three different industries: real estate portfolio/development, professional services, and ecommerce/technology.

Real Estate: Merging vs. Restructuring

For real estate development or portfolio companies, merging with a third party can inject additional capital and expertise, enabling the execution of larger, more ambitious projects. However, this approach often entails diluting equity and potentially sacrificing control over the company’s direction. On the other hand, restructuring can secure necessary funds through debt instruments, though it also carries the risk of encumbering assets.

Professional Services: Merging vs. Restructuring

Professional services firms—such as accountants, CPAs, engineers, and consultants—can benefit from merging by gaining access to new clients and expanding their range of services. However, this strategy may lead to conflicts of interest and dilution of equity. Conversely, restructuring can offer working capital and promote efficiency, but it also incurs the risk of increased debt and interest payments.

Ecommerce/Technology: Merging vs. Restructuring

For ecommerce and technology companies, merging can pave the way to new markets and technologies while also potentially causing culture clashes and equity dilution. Restructuring, meanwhile, can provide working capital for growth but comes with the risk of escalating debt and interest payments.

The Bottom Line

Ultimately, the optimal choice between merging and restructuring depends on each company’s unique circumstances. It’s crucial to weigh the potential benefits and drawbacks of both options and conduct a thorough financial analysis before making a decision.

At Pioneer Real Estate Company, we’re committed to helping our clients make informed decisions that drive sustainable growth. Our expertise in project management, business analytics, financial services, and property management can provide valuable insights and support. Contact us today for a free consultation and subscribe to our Sustainable Investment Digest for more tips and insights on achieving sustainable growth in real estate.

#RealEstate #SustainableGrowth #Merging #Restructuring #QuantitativeRevolution #PioneerRealEstateCompany #Financials #FreeConsultation #SustainableInvestmentDigest.