26

Feb

Measuring Your ESG Impact: A Call to Action

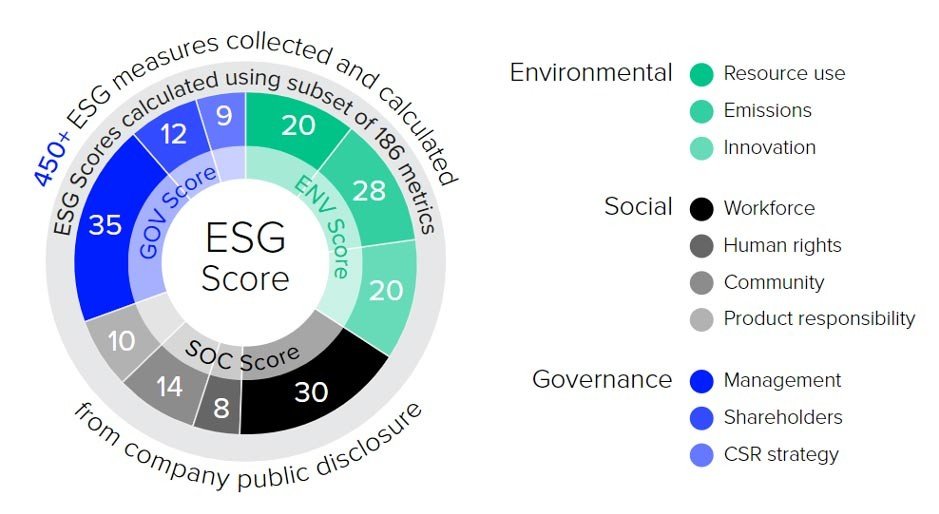

Environmental, social, and governance (#ESG) issues are becoming increasingly important to businesses, investors, and consumers. As a result, there is a growing demand for companies to measure and report on their ESG performance.

There are a number of different ways to measure ESG performance. Some common methods include:

- #Emissions: Companies can measure their emissions of greenhouse gases, such as carbon dioxide, methane, and nitrous oxide.

- #Wateruse: Companies can measure their water use, both in terms of the amount of water they use and the quality of the water they use.

- #Wastegeneration: Companies can measure the amount of waste they generate, both in terms of the quantity of waste and the type of waste.

- #diversityandinclusion: Companies can measure the diversity of their workforce, in terms of factors such as gender, race, ethnicity, and disability.

- #Laborpractices: Companies can measure their labor practices, in terms of factors such as wages, working conditions, and employee safety.

- #Humanrights: Companies can measure their commitment to human rights, in terms of factors such as avoiding child labor and forced labor.

- #communityrelations : Companies can measure their relationships with their local communities, in terms of factors such as corporate giving and volunteerism.

There are a number of different tools and resources available to help companies measure their ESG performance. Some of these resources include:

- The Global Reporting Initiative (#GRI) is a non-profit organization that develops sustainability reporting standards.

- The Carbon Disclosure Project (#CDP) is a non-profit organization that collects climate change data from companies.

- The Sustainability Accounting Standards Board (#SASB) is a non-profit organization that develops sustainability accounting standards.

Measuring and reporting on ESG performance can be a complex and time-consuming process. However, it is an important step for companies that want to demonstrate their commitment to sustainability. By measuring and reporting on their ESG performance, companies can attract and retain customers, attract and retain investors, and mitigate risks.

Some common challenges companies face when implementing ESG metrics include:

• Lack of standardization: There are many different standards and frameworks for ESG reporting, like GRI, SASB, TCFD, etc. This can make it difficult for companies to choose a consistent set of metrics to track and report on.

• Data availability: It can be challenging to obtain accurate and consistent ESG data across a company and its supply chain. This is especially true for Scope 3 emissions and environmental metrics.

• Cost and resource constraints: Measuring and reporting on ESG metrics requires time, money, and staff resources which can be difficult for some companies to dedicate.

• Comparability: The variety of standards and metrics used makes it hard for stakeholders to compare the ESG performance of different companies. This can reduce the motivation for some companies to measure their impact.

• Greenwashing concerns: Some companies are concerned that their ESG reporting efforts may be perceived as “greenwashing” or a PR stunt rather than a genuine attempt to improve sustainability. Robust measurement and transparency can help avoid these concerns.

• Lack of expertise: Some companies struggle with measuring ESG metrics because they lack the internal expertise and knowledge required. They may need help from consultants and advisors to get their program off the ground.

• Integration challenges: For ESG metrics to be meaningful, they need to be integrated into core business decisions and strategy. This level of integration can be difficult for some companies to achieve. Continual progress and learning are required.

• Short-term thinking: Some companies remain focused on short-term financial metrics rather than long-term sustainability. Overcoming this mindset is key to implementing a strong ESG measurement and reporting program.

Those are some of the most significant challenges, in my view. The good news is that as more companies embark on this journey, resources and guidance continue to improve. With time and persistence, these challenges can be overcome.

In addition to the methods and resources mentioned in the article, there are a number of cutting-edge technologies that are available to help companies measure, track, and report on their ESG issues and emissions. These technologies include:

- Artificial intelligence (AI) can be used to analyze large amounts of data to identify trends and patterns that may not be visible to the naked eye.

- Machine learning can be used to develop predictive models that can help companies identify and mitigate risks.

- Blockchain can be used to track and trace the environmental and social impact of products and services.

These technologies can help companies to improve their ESG performance and to make a positive impact on the world.

We offer a variety of services to help companies measure and report on their ESG performance, including:

- Sustainability consulting: We can help you develop a sustainability strategy and implement it across your business.

- ESG reporting: We can help you prepare your ESG reports in accordance with the GRI, CDP, or SASB standards.

- ESG data collection: We can help you collect the data you need to measure your ESG performance.

- ESG training: We can provide training to your employees on ESG issues and how to improve your company’s ESG performance.

Contact us today to learn more about how we can help you measure and report on your ESG impact. Sign up for the Sustainable Investing Digest to learn more about this and other related topics. Subscribe on LinkedIn https://www.linkedin.com/build-relation/newsletter-follow?entityUrn=7053058780464345088