26

Feb

Investing in our Shared Future: How the Water-Energy-Food Nexus Can Drive Sustainable Returns

#SustainableInvesting #ESG #ImpactInvesting

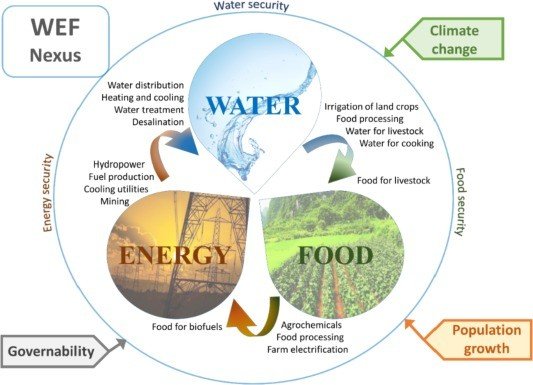

The inextricable links between water, energy and food form an ecosystem that impacts every living being on the planet. Understanding these connections can help investors support innovative companies addressing resource challenges while also generating financial returns.

“We do not inherit the earth from our ancestors, we borrow it from our children.” – Native American Proverb

The droughts intensified by climate change, the power outages caused by storms, and the crop failures exacerbated by warming temperatures all ripple across the water-energy-food nexus. In the U.S., water infrastructure earned a whopping “D” rating in the latest report card by the American Society of Civil Engineers (#ASCE). The average U.S. dam is 57 years old, and many are at or beyond their 50-year lifespans. According to the U.S. Energy Information Administration, weather-related power outages cost the U.S. economy $18 billion to $33 billion per year. At the same time, feeding the global population may require 70% more food by 2050, according to the United Nations.

Companies focused on solutions within the water-energy-food nexus are working to solve these urgent problems. For instance:

Koh Brothers, a Singapore-based infrastructure company, builds wastewater treatment plants that convert sewage into biogas for energy, irrigation water for crops, and potable water for communities.

Aquion Energy’s aqueous organic electrolyte and carbon-based batteries provide renewable energy storage independent of rare earth metals.

AeroFarms cultivates produce for local communities in indoor vertical farms that reduce wasted food, cut transportation needs, and recapture and recycle all irrigation water.

Investing in companies focused on the water-energy-food nexus can transform how we steward our shared resources while also generating financial returns.

Here are some examples of how investing in the water-energy-food nexus has generated financial returns:

•Aquion Energy, mentioned previously, was acquired by Julien Energtech for $183 million in 2017. Investors in Aquion saw significant returns, even though the company was pre-revenue at the time of acquisition based on the promise of their innovative battery technology.

•In India, Jain Irrigation Systems, a producer of drip irrigation systems, water pipes, strawberry fruit puree and other agricultural products has seen its stock price increase over 700% in the past decade. By improving water efficiency for farmers, Jain Irrigation has tapped into huge demand in India for agricultural solutions.

•The Invesco Water Resources ETF has returned 9.3% annually over the past 10 years compared to 8.5% for the S&P 500. This ETF invests in companies involved in transporting, treating, and delivering potable and wastewater. With growing global demand for water infrastructure, these types of water-focused funds have seen strong performance.

•Xylem, a global water technology company that produces pumps, valves, water testing equipment and smart meters, has provided an average annual return of 16.9% since 2011. By helping cities and utilities reduce non-revenue water loss, Xylem’s solutions are financially compelling for its customers and investors.

•Renewable energy companies focused on solar, wind and geothermal power have provided strong returns as the world transitions to more sustainable energy systems. For example, the Invesco WilderHill Clean Energy ETF has returned over 18% annually over the past 5 years, compared to 15.5% for the Nasdaq.

•Indoor vertical farming company AeroFarms raised $100 million to build the world’s largest indoor vertical farm. Investors saw an opportunity to disrupt traditional agriculture with a resource-efficient model that reduces wasted food. AeroFarms aims to generate an internal rate of return of over 16% on projects.

The examples show how companies focused on water, clean energy and sustainable food are generating competitive financial returns, thanks to growing demand for these solutions as populations rise, resources become scarcer and climate change worsens. Sustainable investing in these spaces may prove lucrative over the long run.

How do you think the water-energy-food nexus will evolve in the future?

I see several trends emerging in the water-energy-food nexus:

•Greater integration of systems. As resources become more scarce and constrained, communities will need to integrate how they manage water, energy and food systems. For example, using wastewater for biogas production, then reusing the treated water for irrigation and energy production. Integrated solutions like these maximize efficiency.

•Technological innovation. New technologies like low-energy water desalination, drought-resistant crop breeding, and renewable energy storage will become more critical. Companies developing innovative solutions could see significant growth.

•Decentralization. Rather than large centralized systems, decentralized models may spread. Examples include microgrids for energy, on-site water capture and wastewater treatment for businesses, and vertical farming within cities. Decentralization makes communities more resilient.

•Transition to renewables. The nexus will increasingly rely on renewable energy like solar and wind in place of fossil fuels. This transition will make the overall system more sustainable while creating new opportunities for investors.

•Globalization. Scarcity of resources is a global problem, so technologies, policies and best practices for managing the nexus will spread between countries and regions. Investors may find compelling opportunities in emerging markets.

•More public-private partnerships. Governments will likely partner with private companies to upgrade and build critical infrastructure, using public funds to leverage private capital. Public-private partnerships could provide stable investment opportunities.

• Growing consumer demand. There will be an increase in demand for solutions that boost resilience, increase resource efficiency, and boost efficiency. Companies that meet this demand stand to benefit substantially from growing interest in sustainable investing.

Overall, the water-energy-food nexus of the future may look quite different, but the upcoming changes promise a wealth of opportunities for investors and businesspeople focused on constructing a sustainable future. Communities all over the world will depend on managing this nexus, so businesses operating in this area may see an increase in impact and value over time.

To learn about other sustainable investing opportunities, subscribe to the Sustainable Investing Digest. We can invest in businesses that are paving the way for a more equitable and wholesome future for everyone.

Subscribe on LinkedIn https://www.linkedin.com/build-relation/newsletter-follow?entityUrn=7053058780464345088

References

1. L. Bizikova, D. Roy, D. Swanson, H.D. Venema, M. McCandless, The Water-Energy-Food Security Nexus: towards a practical planning and decision-support framework for landscape investment and risk management

2.International Institute for Sustainable Development, IISD Report, Winnipeg, Canada (2013)

3.C. Ringler, A. Bhaduri, R. Lawford, The Nexus across Water, Energy, Land and Food (WELF): potential for improved resource use efficiency?

4.Current Opinion in Environmental Sustainability, 5 (2013), pp. 617-624, 10.1016/j.cosust.2013.11.002

5.C. Ringler, D. Willenbockel, N. Perez, M. Rosegrant, T. Zhu, N. Matthews

6.Global linkages among Energy, Food and Water: an economic assessment

7.J Environ Soc Sci, 6 (2016), pp. 161-171, 10.1007/s13412-016-0386-5

8.G. Rasul, Food, eater, and energy security in South Asia: a nexus perspective from the hindu kush himalayan region

9.Environ Sci Policy, 39 (2014), pp. 35-48, 10.1016/j.envsci.2014.01.010

10.View PDFView articleView in ScopusGoogle Scholar

11.J.W. Finley, J.N. Seiber, The nexus of food, energy, and water

12.J Agric Food Chem, 62 (2014), pp. 6255-6262, 10.1021/jf501496r View article View in ScopusGoogle Scholar

13.J. Hoff, Understanding the nexus: Background paper for the Bonn 2011 conference: the water, energy and food security nexus, Stockholm Environment Institute, Stockholm, Sweden (2011). Bonn, Germany

14.H. Bellfield, Water, energy and food security nexus in Latin America and the caribbean, Global Canopy Programme, Oxford, UK (2015) Google Scholar

15.D. Wichelns, The Water-Energy-Food Nexus: is the increasing attention warranted, from either a research or policy perspective?

16.Environ Sci Policy, 69 (2017), pp. 113-123, 10.1016/j.envsci.2016.12.018

17.Int J Eng Sci, 7 (1) (2018), pp. 08-24

18.http://theijes.com/papers/vol7-issue1/B0701010824.pdf Google Scholar

19.D.J. Garcia, F. You, The Water-Energy-Food Nexus and process systems engineering: a new focus

20.Comput Chem Eng, 91 (2016), pp. 49-67, 10.1016/j.compchemeng.2016.03.003 2016 View PDFView articleView in ScopusGoogle Scholar