09

Dec

The 195% vs. 24.7% Portfolio Problem: Why Smart Money Is Doubling Down

“An investment in knowledge pays the best interest.” — Benjamin Franklin

Harvard Business Review’s 2023 portfolio study found that investors who diversified across multiple risk-return profiles achieved 47% higher risk-adjusted returns than single-strategy portfolios.1

Yet most storage investors are still doing the opposite—chasing every compressed-cap deal or swinging blindly at developments without portfolio balance.

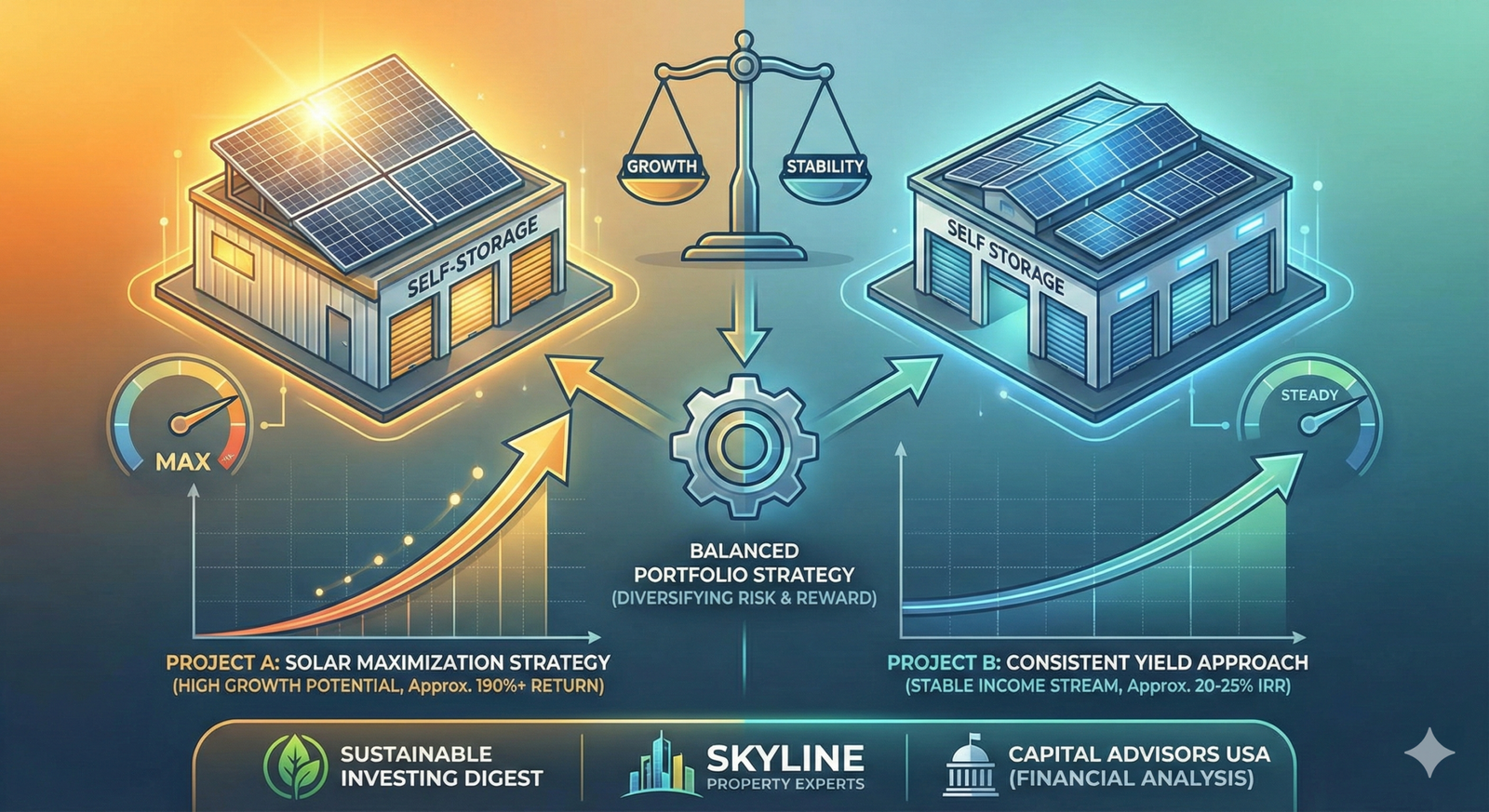

Here’s what elite operators know: Two solar strategies, same market, completely different profiles—when combined, create something neither achieves alone.

Deal A: 195% ROI, 2.47 Sharpe ratio, -3.2% max drawdown. Zero construction risk.

Deal B: 24.7% IRR, 3.84× equity multiple, full capital return Year 5. Development upside.

Blended: 18.9% IRR with 43% faster stress recovery and institutional-grade downside protection.

The 30% ITC drops January 2026. Going-in caps are compressing. Surplus land is disappearing.

Read the full financial breakdown comparing IRR, Sharpe ratios, drawdown analysis, and why 2026 is the last window to capture both strategies at peak efficiency.

📊 Read Full Analysis: https://www.linkedin.com/pulse/solar-showdown-why-one-self-storage-deal-returns-2izkf

📬 Subscribe: Sustainable Investing Digest

📞 Portfolio Strategy Session: scott@skylinepropertyexperts.com | 786-676-4937 | www.skylinepropertyexperts.com

#PortfolioStrategy #SolarStorage #RiskAdjustedReturns #SustainableInvesting #RealEstateInvesting #SelfStorage #IRROptimization #Diversification #SkylinePropertyExperts

Harvard Business Review, “Portfolio Construction and Risk-Adjusted Returns in Alternative Assets,” 2023.