26

Feb

🔋💎 The Key Minerals Driving the Clean Energy Revolution: Meeting the Sustainability Challenge 💎🔋

🌱 “Mining is like a search for buried treasure; it requires hard work, patience, and determination.” – Mark Cutifani, CEO of Anglo American 🌱

The world is undergoing a transformative clean energy revolution, and key minerals are at the forefront, powering the transition. From lithium-ion batteries to rare earth metals essential for electric vehicles and wind turbines, these minerals are driving sustainable technologies. But as demand surges, so do sustainability challenges.

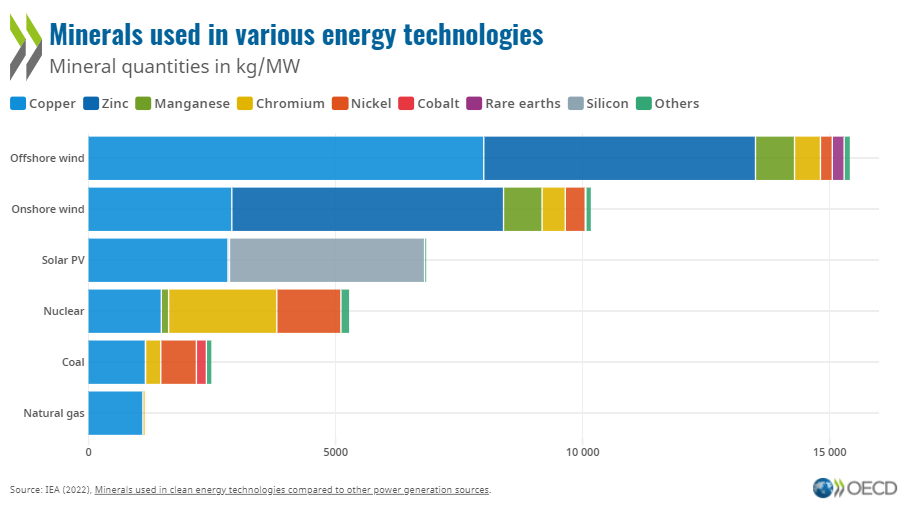

⚡ A Sharp Rise in Demand ⚡ The clean energy boom is set to trigger an exponential rise in mineral demand. By 2050, minerals like lithium, cobalt, and nickel could see an astonishing increase of 400% to 500%. The transition to electric vehicles alone requires six times more minerals compared to traditional gasoline-powered cars. Similarly, wind farms require nine times more minerals than conventional gas-fired power plants.

🔌 Meeting the Demand 🔌 Leading mining companies, including Albemarle, Glencore, Rio Tinto, and Vale, play a pivotal role in supplying these critical minerals. However, ensuring a steady and sustainable supply remains a pressing concern. Presently, around 70% of the world’s lithium comes from China, Chile, and Argentina. On the other hand, the Democratic Republic of Congo currently produces over 60% of global cobalt, while China controls significant portions of the cobalt supply chain, posing potential disruptions for Western automakers.

♻️ Sustainable and Responsible Mining ♻️ Recognizing the environmental impact, the Climate-Smart Mining Initiative strives for sustainable practices to reduce pollution while ensuring reliable supplies. The World Bank also backs projects to enhance governance and enable resource-rich nations to harness mining for their benefit.

However, the push for renewable energy often clashes with threats to Native American lands posed by mining. Despite treaties bolstering tribes’ legal standing against projects, the Biden administration faces a complex decision.

🌐 A Wide Range of Required Minerals 🌐 Clean technologies depend on a vast array of minerals, including copper, nickel, lithium, graphite, rare earth elements, chromium, zinc, platinum, and aluminum. Electric vehicles and batteries alone account for half of the future demand growth, while electricity networks drive 70% of today’s requirements.

The rise of hydrogen applications may also escalate demand for minerals like nickel, zirconium, copper, and platinum-group metals. Rare earth elements, crucial for EV motors and wind turbines, are projected to experience a significant surge in demand.

🏭 Major Players in the Industry 🏭 Critical minerals suppliers include Albemarle, Glencore, Rio Tinto, Vale, Ganfeng Lithium, and Tianqi Lithium. Each company differs in its geographical focus, diversification of metals produced, and adoption of new technologies.

- Albemarle is the world’s largest producer of lithium. It has operations in Australia, Chile, and the United States. The company is also a major producer of other chemicals, including bromine and magnesium.

- Glencore is a diversified mining company with operations in over 35 countries. It is the world’s largest producer of cobalt, a key component in lithium-ion batteries. Glencore also produces a variety of other metals, including copper, zinc, and nickel.

- Rio Tinto is another diversified mining company with operations in over 30 countries. It is the world’s largest producer of copper and the second-largest producer of aluminium. Rio Tinto also produces a variety of other metals, including iron ore, diamonds, and uranium.

- Vale is a Brazilian mining company that is the world’s largest producer of iron ore and nickel. It also produces a variety of other metals, including copper, cobalt, and manganese.

- Ganfeng Lithium is a Chinese mining company that is the world’s largest producer of lithium carbonate. It has operations in China, Australia, and Argentina.

- Tianqi Lithium is another Chinese mining company that is a major producer of lithium carbonate. It has operations in China and Australia.

- SQM is a Chilean mining company that is the world’s largest producer of lithium nitrate. It also produces a variety of other lithium products, including lithium carbonate and lithium hydroxide.

- Livent is an American mining company that is a major producer of lithium carbonate and lithium hydroxide. It has operations in Argentina and the United States.

- Lithium Americas is a Canadian mining company that is developing a number of lithium projects in the United States and Argentina.

- Standard Lithium is a Canadian mining company that is developing a technology to extract lithium from brines using a process that is more environmentally friendly than traditional methods.

- Piedmont Lithium is an American mining company that is developing a lithium project in North Carolina.

The companies listed above are all involved in the mining and production of lithium. However, they differ in a number of ways. For example, Albemarle is a more diversified company than some of the others, as it also produces other chemicals. Glencore and Rio Tinto are even more diversified, as they produce a variety of metals.

The companies listed above also differ in terms of their geographic focus. Albemarle, SQM, and Livent are all focused on the Americas, while Ganfeng Lithium, Tianqi Lithium, and Lithium Americas are all focused on Asia. Standard Lithium and Piedmont Lithium are focused on the United States.

Finally, the companies listed above differ in terms of their use of technology. Albemarle, Vale, and SQM are all leaders in the use of technology in the lithium mining and production industry. Glencore and Rio Tinto are also using technology, but to a lesser extent. Ganfeng Lithium, Tianqi Lithium, Livent, Standard Lithium, and Piedmont Lithium are all still developing their use of technology.

In terms of how these companies compare to mining companies seeking rare earth metals, there are a number of similarities. Both types of companies are involved in the mining and production of essential metals that are used in a variety of high-tech applications. However, there are also some key differences. For example, rare earth metals are typically found in much smaller concentrations than lithium, which makes them more difficult to mine. Additionally, the mining of rare earth metals can be more environmentally damaging than the mining of lithium.

Overall, the companies listed above are all important players in the global lithium and rare earth metals markets. As the demand for these metals continues to grow, these companies are likely to play an even more important role in the future.

Securing reliable supplies of critical minerals is pivotal in facilitating the clean energy transition while minimizing environmental and social impacts. Implementing reuse and recycling practices can also help reduce primary mineral needs. By managing these resources wisely, we can unlock the potential for a sustainable and bright future.

🌿💡 Subscribe to the Sustainable Investing Digest for Deeper Insights 💡🌿 Want to learn more about the significance of mining in the clean energy revolution and the opportunities for sustainable investing? Subscribe to our Sustainable Investing Digest now! Get exclusive access to relevant case studies, cutting-edge research reports, and expert perspectives on how mining can pave the way for a greener and more sustainable future. Together, let’s power the clean energy revolution while preserving the planet for generations to come. #SustainableMining #CleanEnergyRevolution 🌍🚀